This interest rate is calculated every month and then transferred to. EMPLOYEES PROVIDENT FUND ACT 1991 THIRD SCHEDULE Sections 43 and 44A RATE OF MONTHLY CONTRIBUTIONS.

Confluence Mobile Support Wiki

The EPF contribution rate for the financial year 2021 is 85.

. In order to give people more disposable income the government. The current interest rate for EPF for the FY 2021-22 is 810 pa. 15000 also only Rs.

Earlier the EPF functioned based on contributing 12 of their monthly salary towards EPF while the employer. An employee with a salary less than RM5000 will have employer contribution of. The employer contribution for the employee is at 13 and 12 depending on the salary of the employee.

Employee Provident Fund Interest Rate. From the age of 60 only employer contributions are payable. The latest contribution rate for employees and employers effective July 2022 salarywage can be referred in theThird Schedule EPF Act 1991.

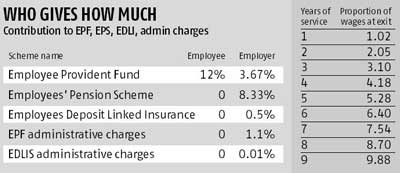

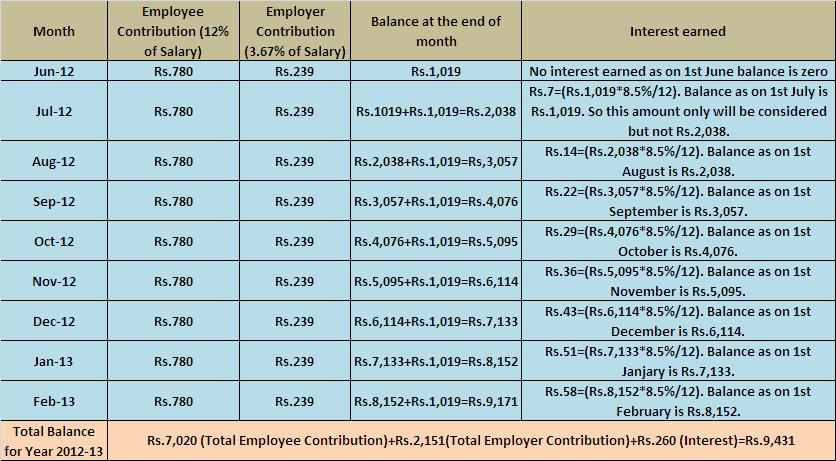

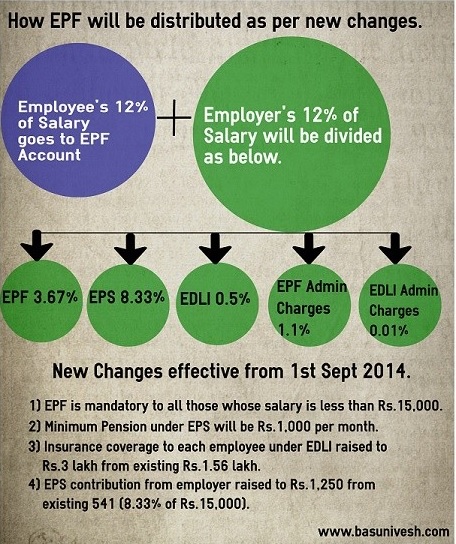

From the employers share of contribution 833 is contributed towards the Employees Pension Scheme and the remaining 367 is contributed to the EPF Scheme. Employees Provident Fund- Contribution Rate The EPF MP Act 1952 was enacted by Parliament and came into force with effect from 4th March 1952. 1250 which is 833 of Rs.

Corrigendum to circular dated 06042022 on Calculation and deduction of taxable interest relating to contribution in a provident fund exceeding specified limit. The standard practice for EPF contribution by employer and employee are. 15000 of the salary.

Following the Budget 2021 announcement employees EPF contribution rate for all employees under 60 years old is reduced from 11 to 9 by default from February 2021. Employers are required to. The EPFO s pension scheme is likely.

The monthly EPF contribution rate of 9 will end on June 30 and will return to 11 in July. However new Indian Budget for 2015 was released bringing relief to some. The investment Division manages the EPFs investment fund with two primary long-term investment objectives - to preserve and enhance the value of capital from members.

The contribution to the EPS is limited to Rs. 6 hours agoThe employees provident fund contribution is currently mandatory for only those organised workers earning above Rs 15000 per month. Employer at 12 or 13 whereas employee contributes 11 of monthly salary to the EPF.

If the basic salary is more than Rs. The EPF contribution rates vary according to the. As a result of the announcement made on Budget 2021 the statutory EPF contribution rate for employees was reduced from 11 to 9 beginning on January 1 2021.

All employees must contribute until the age of 75 with no minimum age. 1250 is contributed to.

Epf Payment Online Procedure Receipt Download Late Payment Penalty

Epf S Employees Pension Scheme New Amendments

Employee Provident Fund Epf Changed Rules From 1st Sept 2014

Epf Admin Charges Reduced From April 2017 Updated Epf Rates Simple Tax India

Epf Ppt Learning And Detail About Epf Eps And Benefits Of Contribut

Pf Interest Rate Calculator Clearance 56 Off Www Ingeniovirtual Com

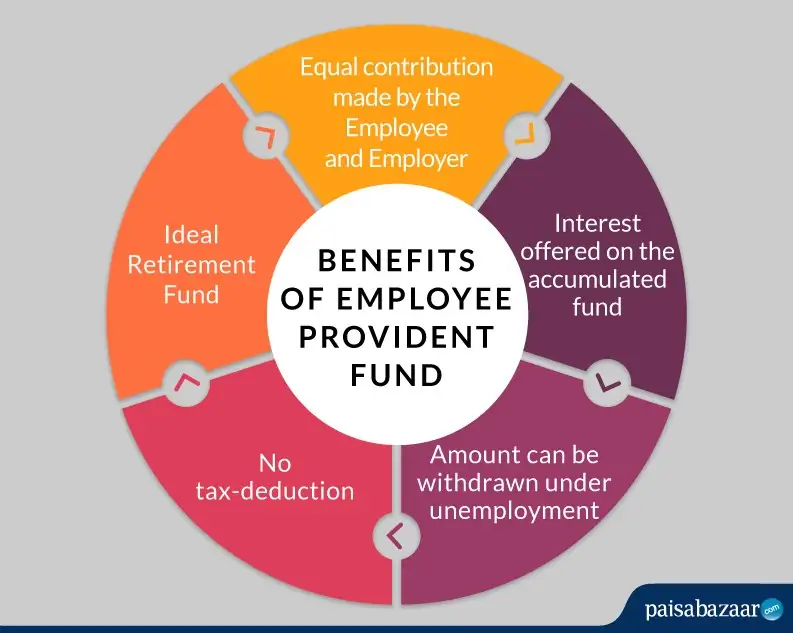

All Employee Provident Fund Questions Answered

Epf Contribution Rate For Employee And Employer In 2019 Planmoneytax

Govt Reduces Pf Administrative Charges Effective From Jan 2015 Sap Blogs

Epf Contribution Rates 1952 2009 Download Table

How Epf Employees Provident Fund Interest Is Calculated

The Complete Guide To Employee Pension Scheme Eps 1995

Faq Employer Epf Contribution Rate 13 Wage Rm5 000 Or Below 1jan2012

20 Kwsp 7 Contribution Rate Png Kwspblogs

New Epf Rules 2021 Latest Amendments To Epf Act

Pf Contribution Rate From Salary Explained

Epf Interest Rate 2021 22 How To Calculate Interest On Epf

Pf Calculator On Salary Cheap Sale 58 Off Www Vicentevilasl Com